Continuum Green Energy (India) Private Limited (“Continuum Green Energy”), wholly owned by Continuum Green Energy Limited (Singapore), is our holding company in India engaged in the business of renewable energy generation through wind and wind-solar hybrid projects housed under various subsidiaries. Continuum Group consists of Continuum Green Energy, its parent, its subsidiaries, step down subsidiaries and fellow subsidiaries. We welcome you to Continuum Green Energy’s first sustainability report.

It provides a comprehensive view of our value-driven journey from April 1, 2021, to March 31, 2022 to facilitate India's clean, reliable and affordable energy ecosystem. We are committed to playing a pivotal role in enhancing India's energy security through the responsible generation of renewable energy. Our first sustainability report seeks to update our stakeholders on the sustainable impact of our value creation efforts through FY 2021-22 across different facets of the renewable energy supply chain while balancing the needs of the planet and profitability.

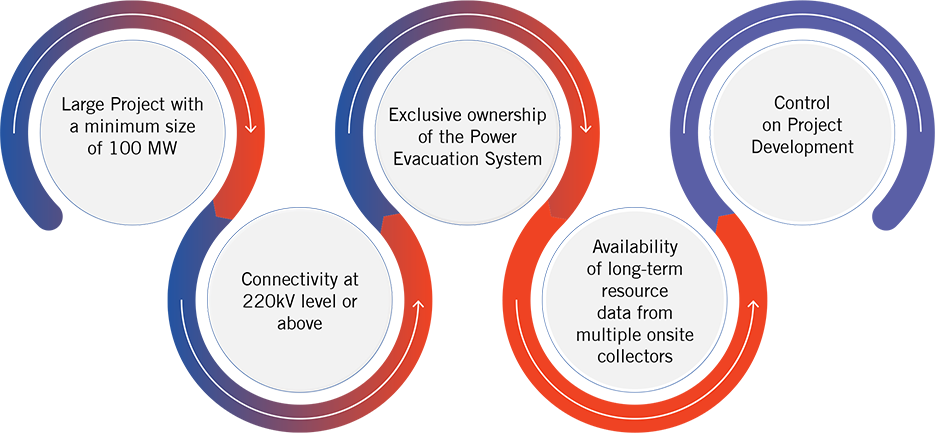

We offer different C&I PPAs model to our C&I consumers, depending upon their needs, as summarized below:

Through

FY 2021-22, we produced 1,801 GWh of renewable energy, equivalent

to avoiding 1.6 mn Tonnes of CO2 in the same

period. This is equivalent to Annual Green-House Gas

Emissions from:

As we strengthen our capabilities and expand our footprint to cement our position in the renewable energy sector in India, we know that along with the opportunities, there will be risks. However, studies have shown that an ESG led growth and operational strategy not only offers a higher potential of returns for a company and their stakeholders but also a reduction in their risk exposure. Our robust risk management framework enables us to monitor, manage and mitigate these risks in a timely manner and run seamless operations without disruptions.

At the core of our business lie our stakeholder’s expectations and demands. We conducted a comprehensive exercise to engage with our stakeholders to garner their inputs on the issues, which they believe could have the most impact on our business. These material issues form the pillars of our ESG led growth strategy as we explore new avenues to enhance our value creation abilities and seek new horizons of growth.

Interweaving a robust ESG framework within our business strategy further strengthens the foundation of our business and enhances our value creation abilities for our stakeholders. Using scarce natural resources prudently, managing the waste we generate, implementing technology and innovations to reduce our carbon footprint and running safe operations are critical for our continued success. To operate in harmony with our communities is imperative if we want to run our business without disruptions, foster inclusive development, protect and enhance our reputation and strengthen our social licence to operate.

We are defining an agile, scalable and responsive roadmap to translate the goals of our ESG strategy into tangible and sustainable value for our company and our stakeholders. This roadmap will guide us to meet our financial and non-financial commitments, establish scalable and responsible operational models, build a future-ready talent pool and generate profits while protecting our planet and people.

Underlining this approach is our comprehensive governance framework of policies, processes and controls that enable us to facilitate effective decision making, comply with regulations and the law and earn the trust of our internal and external stakeholders through transparent and ethical conduct.

As a sustainable business, we are accountable for running our operations responsibly with due consideration to our environmental footprint, nurturing inclusive development, and leading with ethics at all times.

To guide our company on a sustainable growth path, we used the findings of our Materiality Assessment to frame our ESG strategy that is built on the three pillars of Contributing to Environment, Society and the Future with eight focus areas.

Supporting Governance Structure

We have undertaken a

structured process to identify business risks in line with our

business objectives drawn from internal

consultations with our stakeholders and discussions with

the Senior Management team. These are outlined below: